Short Selling Houses

Since the housing market in Portland (and my neighborhood especially) is really hot right now I’ve been thinking a lot about home values and whether or not to sell. One bit of advice I heard a few years ago that I’ve always been intrigued by was the idea of selling your home in the summer, when home values are the highest, renting for 6 months, then buying in the winter, when home values are the lowest. The idea is somewhat similar to short selling, in that profits are directly proportional to losses in the market.

To dig into this a little deeper, we need to start with some assumptions

The home we buy must be of equal or greater value to the home we sell at all times.

We’ll be looking at houses in the same city which should be rising and falling at the same rate, and we want to make sure we’re not downgrading.

Rent will not be less than the mortgage payment.

Landlords usually have mortgages too, and we don’t want to downgrade too much during the rental period.

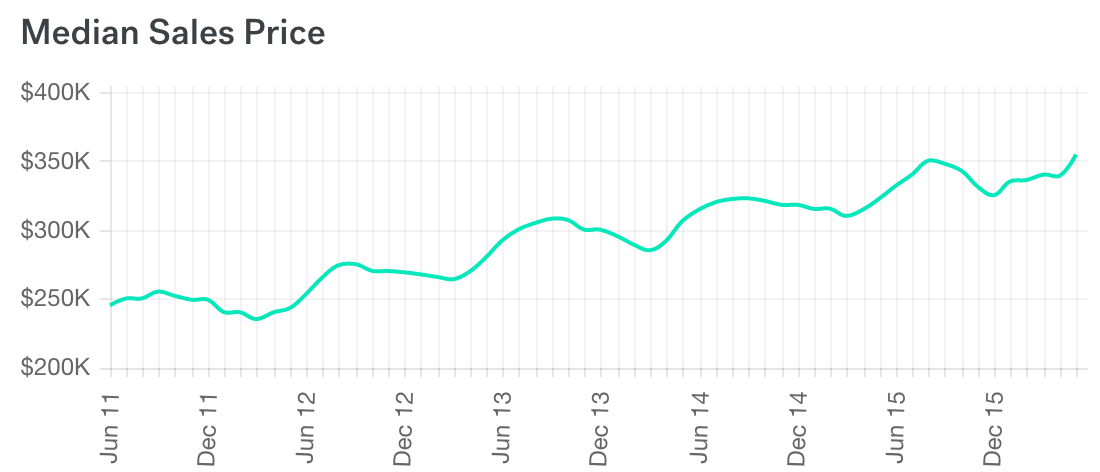

Looking at home values over the last few years, you can clearly see a seasonal rise and fall in home values, higher in the summer and lower in the winter. This gives hope that it might really be possible to make money by delaying buying after selling.

We want the housing market to lose as much of its value as possible between selling and buying 6 months later. To make any profit, home values must drop enough to cover selling costs, the increase in monthly housing costs, and the principal we would have put into our house during the rental period if we hadn’t sold.

cost_of_renting = monthly_rent * months

cost_of_owning = (monthly_mortgage - monthly_principal_paid) * months

revenue = sell_price + cost_of_owning

expenses = buy_price + selling_costs + cost_of_renting

# profit = revenue - expenses

profit = (sell_price + monthly_mortgage*months) - (buy_price + selling_costs + monthly_rent*months - monthly_principal_paid*months)

Based on my completely unscientific practice of randomly looking at different areas in Trulia, it seems like summer time generally accounts for almost all of the yearly growth, and the winter generally loses about 10-20% of what the summer gained. Since we’re only concerned with losses, and since year-over-year growth in my area last year was are around 20%, I’m going to use a buy_price 4% less than my sell_price (20% * 20% = 4%). To help our profits a little more, I’ll also assume monthly_rent and monthly_mortgage are equal. Finally, selling a house in a reasonable amount of time usually requires a realtor, and realtor commissions are usually about 6%, so we’ll stick with that.

sell_price = 300_000

buy_price = 300_000 * (1 - 0.04) # 288,000

selling_costs = 300_000 * 0.06 # 18,000

monthly_rent = 1_500

monthly_mortgage = 1_500

monthly_principal_paid = 300

cost_of_renting = 1_500*6 # 9,000

cost_of_owning = (1_500 - 300)*6 # 7,200

profit = (300_000 + 7_200) - (288_000 + 18_000 + 9_000) # -7,800

That puts us $7,800 in the red for selling our hypothetical house in the summer and buying one of equal value in the winter. But there is still the income from selling the house to consider. Assuming 25% equity, that gives us $57,000 to invest elsewhere while we rent.

selling_costs = 300_000 * 0.06 # 18,000

equity = 300_000 * 0.25 # 75,000

revenue = equity - selling_costs # 57,000

Historically the stock market as a whole averages 10.4% per year, and if we could count on that return we would make $2,890.70 in 6 months, though the portfolio required to get that rate would be almost as likely to lose that much in the 6 months we could invest it. The better choice would be to invest the majority of that money in bonds, CDs, or money markets that are much safer but unfortunately have much lower returns (0.5-1% currently), which only gets us $284 in 6 months (not counting brokerage fees).

future_value = present_value * (1 + rate)^time

# risky portfolio

57_000 * (1 + .104)^.5 # 59,890.70

# safer portfolio

57_000 * (1 + .01)^.5 # 57,284.29

So, in a perfect world where we can sell at the absolute top of the market and buy at the absolute bottom 6 months later, and find a suitable rental between for the same price, the total profit (not counting moving expenses, storage, taxes, brokerage fees, closing costs, title insurance, HOA fees, or anything else I’ve forgotten) is $-7,515.71.

The biggest expense cutting into our profits from this example was the realtor fees, as you can see from the graph below, as long as the market drop is less than the realtor fees, its almost impossible to come out ahead. While there are ways to save money on realtor fees such as selling yourself or using an online listing agent, short-selling houses just doesn’t seem like a practical way to make money to me.

Leave a Comment